kentucky inheritance tax calculator

Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Class b beneficiaries are subject to an inheritance tax ranging from 4 to 16 class c beneficiaries are subject to an inheritance tax ranging from 6.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The range we have provided in the.

. The inheritance tax is not the same as the estate tax. Get Started In Your Future. Failure to File or Failure to Furnish Information - Five 5 percent of the estimated tax due assessed by the Department of Revenue for each 30 days.

Your household income location filing status and number of personal. The inheritance tax in this example is 76670. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Get Started In Your Future. Find A One-Stop Option That Fits Your Investment Strategy.

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. Kentucky imposes a flat income tax of 5. Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Kentucky inheritance tax is a tax on the right to receive property upon the. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

It must be filed within 18 months of the. Overview of Kentucky Taxes. The tax rate is the same no matter what filing status you use.

The highest property tax rate in the state is in Campbell County at 118 whereas the. The minimum penalty is 25. Youll pay taxes based on the amount of your inheritance not the value of the entire estate.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed. Find A One-Stop Option That Fits Your Investment Strategy.

In Kentucky you need to file an inheritance tax return when you receive an inheritance. 6 of amount over. The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000.

States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Kentucky is a reasonably friendly tax state.

Aside from state and federal taxes many Kentucky. Class A beneficiaries pay no taxes on their. 300 Definitions for KRS 140310 to 140360.

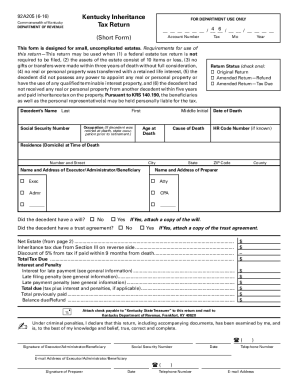

Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent. 92A200 6-16 Commonwealth of Kentucky DEPARTMENT OF REVENUE KENTUCKY INHERITANCE TAX RETURN Requirements for use of this returnThis return is to be filed. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Kentucky has an inheritance tax ranging from 4 to 16 that varies based on. This inheritance tax is only levied against the estates of residents and nonresidents who own property in Kentucky.

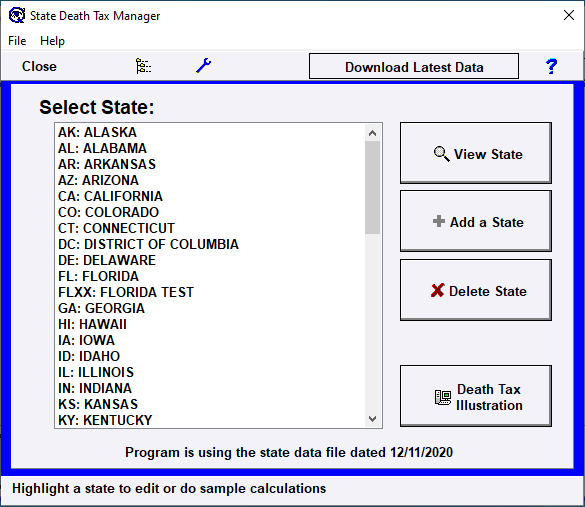

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

What Is Inheritance Tax Probate Advance

Inheritance Tax Who Why How Internal Revenue Code Simplified

Kentucky Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Is It What To Expect Full Guide

Kentucky Income Tax Calculator Smartasset

States With Inheritance Tax Or Estate Tax Bookkeepers Com

How To Pay Inheritance Tax With Pictures Wikihow Life

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Kentucky Inheritance Tax Fill Online Printable Fillable Blank Pdffiller

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

California Estate Tax Everything You Need To Know Smartasset

Calculating Inheritance Tax Laws Com

Kentucky Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow